For holding, as a company with a large number of legal entities, it is important to timely and transparently analyze the tax efficiency of its enterprises. To achieve this, it is necessary to collect tax data from various sources, perform tax planning, and track tax coefficient values. Therefore, the main objectives of the project were:

- Automation of data collection

- Creation of a data model for storing, planning, and calculating taxes

- Building of analytical dashboards

Holding has various IT systems within its structure, so it was important to adhere to the established architecture during the project. After determining the source systems and developing a general approach, the following architecture was chosen:

- SAP Analytics Cloud – the main system for the project (analytics and planning)

- SAP HANA - central Data Warehouse (DWH)

- Medoc, SAP ERP, 1C, Excel files - data sources

The integration with Medoc and the data loading of declarations and their attachments posed a challenge. To observe the high security measures of Medoc servers, integration was implemented using XML files. Given the intricate structure of these files, SAP Data Services proved to be instrumental. This tool facilitated the seamless loading of data from any file format into the Data Warehouse.

Thus, all the necessary data for analysis for each legal entity and the overall holding is collected from the source systems. Users enrich the loaded data with specific tax information and planning data using input forms.

During the project, a model was developed in which all indicators are calculated in real-time without the need for manual calculations. As a result, dashboards and summary reports always reflect the most up-to-date situation, reducing the involvement of tax managers in the process.

The customers received the following analytical reports and dashboards as a result:

- Tax payments

- VAT and corporate income tax

- Tax debts and overpayments

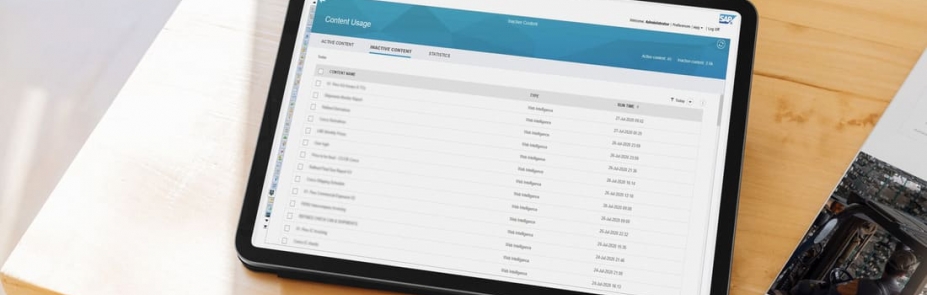

- Consolidated dashboard with key performance indicators for tablets.

Tax managers can provide comments on their data directly in the reports to provide explanations and make the dashboards more informative.

During the project, it was important to preserve and adhere to the existing architecture while incorporating necessary enhancements.

Considering the presence of multiple source systems, the success factors of the project included the utilization of the modern SAP HANA Data Warehouse (DWH) as a buffering system. Meanwhile, the cloud-based solution, SAP Analytics Cloud provided planning and analytics functions with a user-friendly interface. This allowed tax managers to quickly engage with the system and consultants to efficiently scale the model.

As a result of the project, the tax department obtained a system for timely and transparent analysis of tax efficiency, both at the Holding level and for individual legal entities. With the start of productive operation, new ideas emerge, paving the way for further advancements.